Every organization requires a strong fundraising strategy to meet its goals. When you see your investors and funders, you work to understand their mission and motivations as deeply as you can. This is because we know that the best partnerships come from a place where your investors and your goals are deeply lined up.

According to a deep study analysis on startups, researchers noticed some differences between founders of businesses. The primary difference between founders who have good fundraising and those who do not is the difference between the structure and process of their fundraising procedure.

A good fundraising strategy answers these five questions clearly:

Why, Who, How Much, How, and When.

- Why are you raising capital?

- How much capital will you raise?

- Who are you raising capital from?

- When you are raising capital?

All of this should be for both now and in the future. So what’s the process you will follow to successfully raise your fund? In this blog, we will cover all types of questions and how to structure your plan and fundraising strategy. We have also mentioned how to prepare for your upcoming round.

What Is Fund Raising Strategy

A fundraising strategy is prominent, simply put, as it is how you work out on raising investor capital. In simple words, it’s a written document that is not too long and complex. It’s just one page that answers all the important questions about upcoming rounds. The document will assist your team with an organized order to get clear on what is going on in the document.

Why to Raise Capital?

No matter what your startup, goals, and valuation are, one thing is for sure: you need to know why you are looking for investor capital. If you are not clear about your investment, you will lose track, and your round will be flopped.

Top Reasons Why Investor Capital Can Benefit Your Company

Here are some reasons that will explain to you why it is important to have investor capital for your company:

| Reasons | Explanations |

| Expanding Business | Capital can be used to expand your business. |

| Hiring | It also helps in hiring new employees. |

| Research & Development | This assists in developing and researching new products. |

| Efficiency | Helps companies in boosting operational efficiency. |

| Revenue | Allow companies to generate revenue for several years by adding production facilities. |

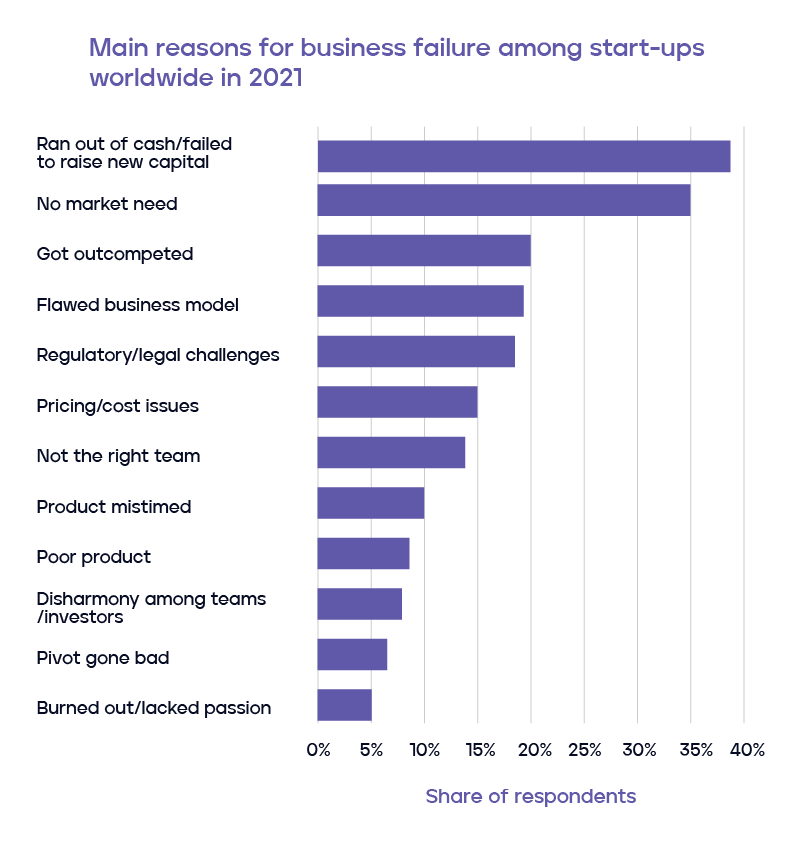

The below graph shows some important reasons why most startups fail:

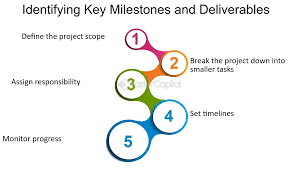

Major Milestones Capital Lets Your Business To Reach

Other than reasons, we suggest you be clear about the milestones and objectives that investor money will let you reach. Which large milestone can you reach and can you get to the next milestones quicker by raising money?

Pen down the important Investor mindset milestones that will make an impact on your company in general. Highlight the milestones that will truly move the needle for you to become a successful company.

You need to be clear on how and why specifically this capital will contribute to you building this company. How will the amount be allocated, to which areas of the business, why is it important, and where will that take you? Here are some important elements milestones help you in achieving:

- Getting repeated customers

- Achieving huge ROI on marketing efforts

- Getting your first review

- Outsourcing your first business function

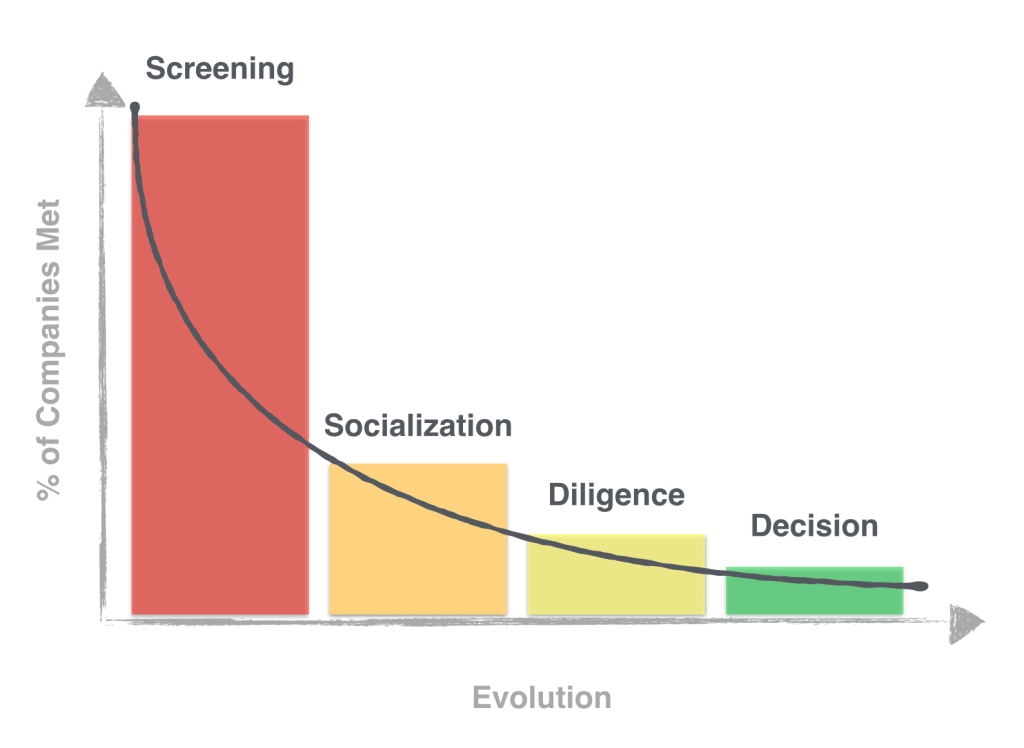

How to Look For Investors

A warm introduction is the best way to get in touch with a new investor.

The best way to get in touch with investors is to reach out to people you know in the local market and ask for referrals. To get referrals, begin connecting with mentors, industry, peers, and those who have already directed the fundraising environment in your industry.

A great idea when connecting with investors is to conduct your diligence on them. Get in touch with the companies they invested in or some other people who know them. Ask how they are to work with, how active they are in assisting, and how they are as a person in general.

Picking investors that will not only offer the capital but also truly believe in you and stay with you through the thick and thin. Most importantly, you need to bring on investors who are somehow active and will assist you through your major milestones.

These points are also applicable to practical startup growth strategies. Even if you are thinking of starting a new business or your business is new in the market, these points will be helpful to you.

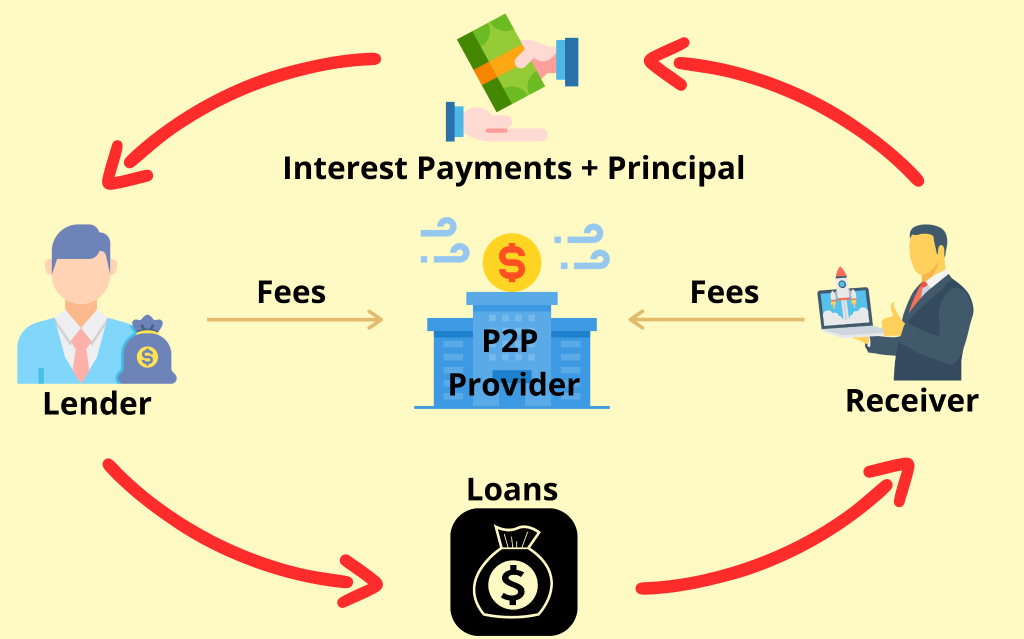

Process for Raising Funds

Here, we have mentioned important points about the fundraising process.

- You need a proper and organized plan.

- This should be managed and approached as a procedure by which you will manage the contacts of your investors.

- Which channels will you use to reach them?

- What is your pitch going to sound like?

- Which documents you should already have to send with your pitch?

- Who can help you get in touch with the right investors?

Let’s read about the procedure in detail here:

- Prepare The Package Of Your Document

This package includes:

- Your pitch deck

- Introduction of one-page

- Budget that depends on how old your company is

- Financial projections and key metrics like customers and revenues.

- You can also include business and financial models.

- Important Contracts With Employees And Partners

You also need to include a final investment document or a term sheet if it’s in the beginning stage round. In this way an investor can already see how you intend to execute the round and they can negotiate or give feedback. If it’s the beginning and you just beginning, a budget and deck may, in some cases, be enough.

- Investor CRM

Another great thing you can do is to set up a CRM with the sole purpose of managing all your investor contacts. There are various platforms that you can use, such as Hub Spot. Some of the workflows there can be automated, and the best thing is that the board is free.

For this, you need the below-mentioned information:

- Phone number

- Type of investor they are

- Ticket Size

- Round focus

- Industry focus

So, for all this documentation, you need professional Business Plan Writers. Business writers know what investors are looking for, and they help you craft a document that exactly fits the preferences of investors.

Frequently Asked Questions

- What is a fundraising strategy?

A fundraising strategy is a plan for how you will raise money from investors. It outlines your goals and the steps you will take to reach them. This plan helps keep your team focused and organized. It should be simple and easy to understand.

- Why do I need to raise capital?

Raising capital helps your business grow and achieve its goals. You can use the funds for hiring, research, and expanding your operations. Without investor capital, it can be hard to reach important milestones. It’s crucial for long-term success.

- How do I find the right investors?

Start by asking your network for referrals to potential investors. Look for people who believe in your vision and can offer support. Do some research on their past investments and approach them with a clear plan. A warm introduction can make a big difference.

Summing Up the Strategies for Fund Raising

A strong fundraising strategy is necessary for the success of your organization. By defining your goals clearly and understanding your investors, you can build effective partnerships. Remember to keep your plan organized and focused on key milestones. With the right approach, you can raise the capital needed to achieve your vision.